South Africa’s digital payments landscape is undergoing a seismic shift, with demand for instant payments rocketing and the mobile banking app displacing older interfaces as the preferred way to pay.

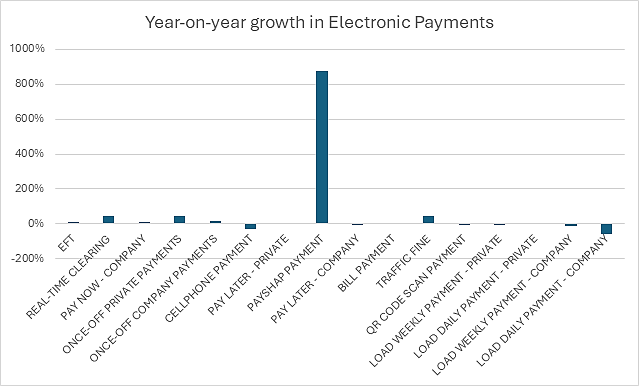

Over the past year, Standard Bank SA recorded a 21% growth in digital payments initiated by its personal and private banking customers in South Africa. The demand for instant transactions exploded, with Payshap adoption rising tenfold since its 2023 launch, and Real-Time Clearing (RTC) volumes leaping by over 40% year-on-year. Even traditional electronic fund transfers (EFTs) continue their upward trajectory, underscoring the comprehensive embrace of digital payment solutions.

“This dramatic increase signals not just heightened consumer comfort and expanded solution offerings, but a fundamental change in how South African consumers conduct their payments,” says Rufaida Hamilton, Standard Bank’s Head of Payments in South Africa.

Source: Standard Bank Personal & Private Banking SA

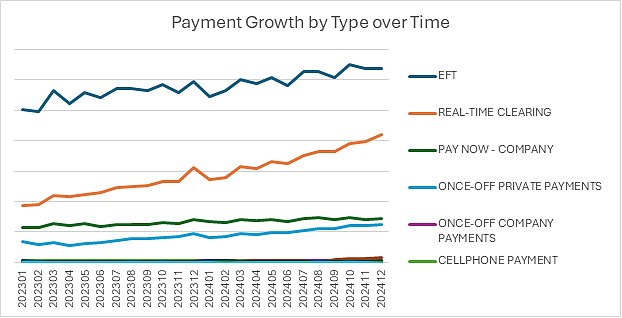

The past years’ experience was consistent with a long-term trend, in which Standard Bank personal and private banking recorded consistent month-on-month growth in digital payments.

“However, not all digital avenues are following the same path. USSD cell phone payments have declined in volume by 32% year-on-year, and recurring weekly payments aren’t keeping pace with overall growth pattern. While we continue to monitor these trends, they indicate that clients are adapting to true digital in transitioning to the mobile app and client payment patterns are evolving. Therefore, we see that activity on our SBSA Mobile App is growing rapidly, driven by rising smartphone use and demand for on-the-go transactions,” says Hamilton.

She adds that the decline in USSD usage, the technology meant for non-smartphone users, highlights how widespread smartphone adoption has become, and that enhancing mobile technology is the key driver to growing digital payments even further.

Across internet banking, mobile app and USSD, Electronic funds transfer (EFT) continue to be the most preferred among digital payment methods, retaining a 50% share of electronic payments. But real-time clearing specifically has grown so rapidly and now accounts for 28% of electronic payments transaction, becoming the second most-used method after EFT.

Source: Standard Bank Personal & Private Banking SA

Who pays who, when?

The most active group making payments among consumers is between the ages of 36 to 45, reflecting higher economic activity and digital adoption in this client base. Conversely, digital payment activity within the clients over the age of 65 shows the least digital payments activity.

“However, while this age group dominates transaction volume, the 16-25 year age range exhibits the most significant year-on-year growth, showing us that this generation has a greater propensity to fully embrace digital financial solutions,” says Hamilton.

Geographically, digital payment activity mirrors regional economic activity. Gauteng leads the charge, accounting for 38% of all payment’s activity in any given month. This is followed by the Western Cape (18%) and KwaZulu-Natal (17%). Conversely, the North-West Province represents the region with the lowest transactional activity.

Source: Standard Bank Personal & Private Banking SA

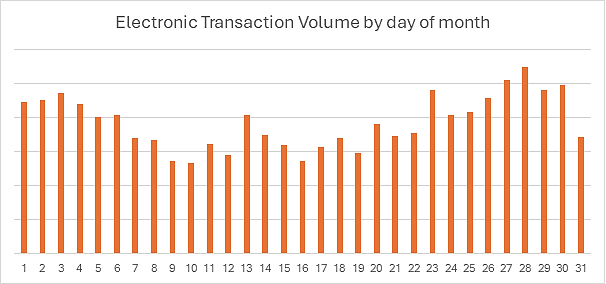

In terms of timing, while digital payment activity occurs throughout the month, a significant surge occurs between the 25th and 3rd. This aligns with salary payment periods and heightened retail activity. Conversely, the periods between the 7th to 12th and 16th to 22nd experience a noticeable decline in payments activity. A minor mid-month peak, driven primarily by government employee salary payments, provides a slight uplift during this period.

This surge in digital payments—particularly among younger segments—signals a decisive shift in how customers want to bank. By embracing this change and continuing to prioritize mobile-first, instant experiences, Standard Bank is well-positioned to lead the next phase of payments innovation.

INFO SUPPLIED.