South Africa’s popular money transfer, eWallet soared to 67 million in transactional volumes in 2023

FNB’s renowned eWallet service has been recognised as an Icon Brand and a winner of the Money Transfer Category in the 2023/2024 Ask Afrika Icon Brands™ Benchmark Survey for the second consecutive year. According to the survey, an Icon Brand is one that unites a nation, one that South Africans are loyal to, and one that South Africans are committed to. One of the main objectives of this study is to identify brands that have become iconic with South African consumers.

Refilwe Sebothoma, eWallet Product Head at FNB Personal Segment, says, “Receiving the accolade back-to-back is testament to the sustained growth in eWallet usage since the digital money transfer solution was launched in October 2009. It also reflects the unwavering trust and loyalty of South Africans who continue to choose eWallet as their preferred solution to send or receive money digitally.”

“In 2023, we have seen substantial growth in eWallet transactional volumes that amounted to 67 million. The growth in eWallet transactions is a reflection of the enormously positive impact we are making – across rural areas, townships, and urban communities. We aim to continuously lead the pack with integrated and innovative customer-centric solutions that are helpful, easy, and safe for South Africans”, she adds.

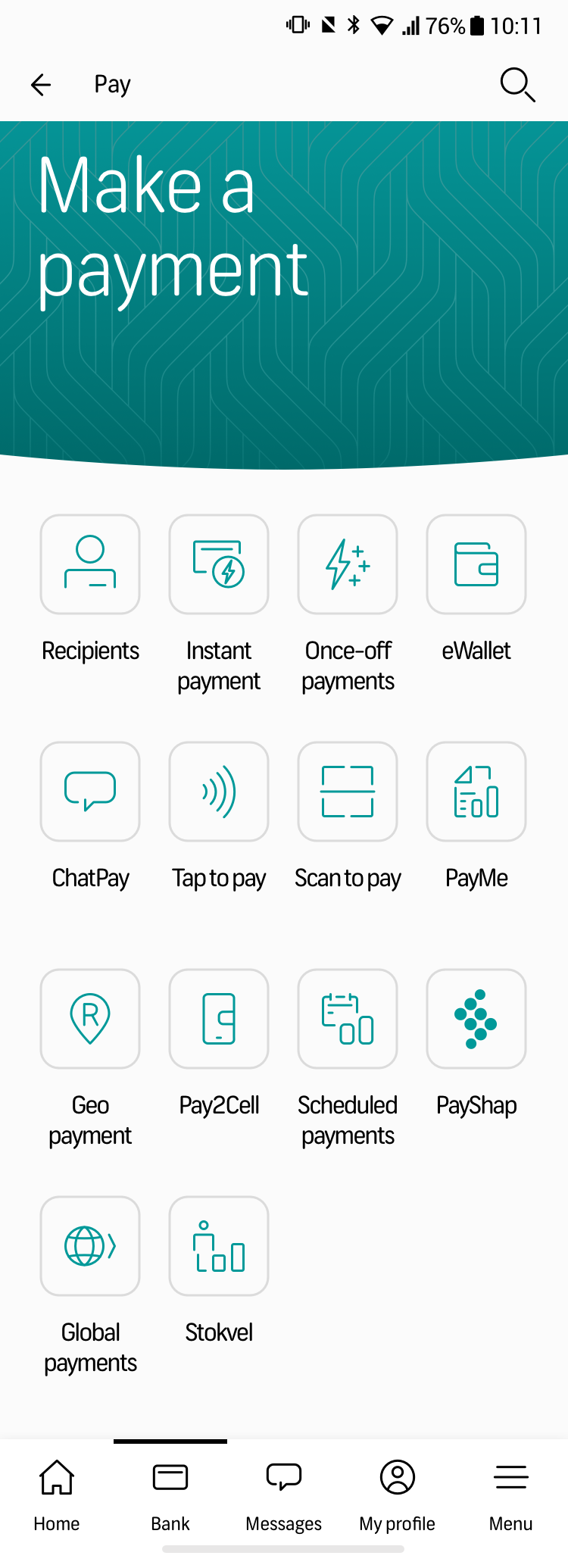

Palesa Nhlapo, Customer Value Proposition Head at FNB Personal Segment, further highlights, “Beyond the cash send and withdrawal benefit, we have evolved South Africa’s popular money transfer solution and adapted it to fit the lifestyle needs of our customers. eWallet funds can be spent on groceries purchases at selected retailers – SPAR and TotalEnergies. This includes purchasing electricity, airtime, data or paying for DSTV on the eWallet mobile platform. Another added value for our FNB Easy PAYU to Private Wealth accounts is that we’ve since introduced free Send Money (eWallet) transactions made on the FNB banking App and cellphone banking.”

FNB has leveraged the success and popularity of eWallet to provide more cost-effective solutions for Entry level customers. As a bank, we expanded our offerings to Entry level customers a few years ago with the introduction of the FNB Easy Zero bank account. This low-cost transactional bank account offers various zero-rated transactional benefits including receiving eWallet directly into the account. Users of Easy Zero do not pay a monthly account fee, and the account can be opened using cellphone banking (USSD).

“We are proud to continue witnessing the popularity of this digital money transfer innovation to empower consumers by transcending geographical barriers and to promote financial inclusion. FNB eWallet is strategically created to ensure that people are not excluded from financial activity simply because they don’t have a bank account,” concluded Sebothoma.

INFO SUPPLIED.