John Loos

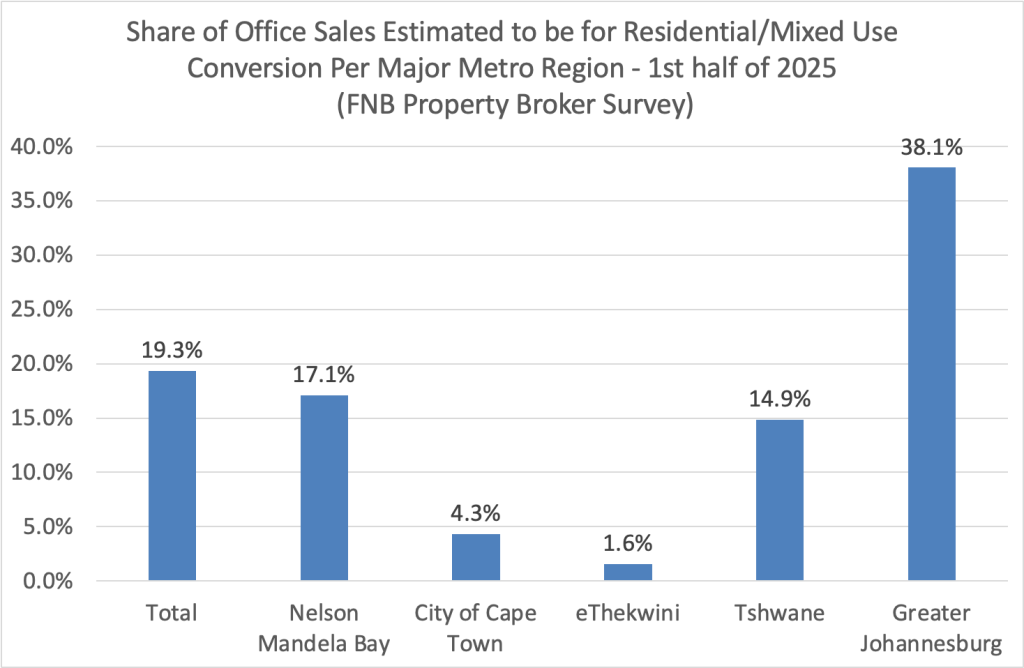

Brokers estimate that a notable 19.3% of office property purchases are intended for conversion to residential or mixed-use developments. In Johannesburg, this figure is estimated at a significant 38.1%.

The Office Market’s Oversupply Was About More Than Just Covid-19:

Many of the challenges facing the office property market in recent years have been well-documented. When Covid-19 lockdowns began in 2020, there was a surge in remote and hybrid working, sparking debate around the future need for office space. Some companies reduced their office footprints to accommodate greater levels of remote work.

While much of the initial hype around working from home (WFH) was overblown, many employees eventually returned to the office—though not in the same numbers as before the pandemic. Long before Covid-19, however, advances in technology had already enabled more flexible work arrangements. These trends are expected to continue gradually in the post-pandemic “new normal.”

Additionally, productivity improvements driven by technology have allowed office-dependent sectors to grow without proportionally increasing their workforce numbers, curbing long-term demand for office space. At the same time, digitisation has reduced the need for physical document storage, further lowering space requirements.

South Africa’s sluggish economic growth since the early 2010s has also played a role, limiting formal employment growth and, by extension, the demand for office space.

Unsurprisingly, these factors led to a sharp rise in the national office vacancy rate—from a post-GFC low of 9.2% in 2014 (MSCI data) to a peak of 18.2% in 2021/22, shortly after the hard lockdowns.

Signs of Improvement:

Since 2021/22, there have been encouraging signs of declining oversupply, particularly in the major coastal cities. The national office vacancy rate declined to 15.8% in 2024—still high, but a notable improvement.

Rode data paints a similar picture, with national average A+, A, and B-grade office vacancy rates dropping from nearly 18% in the first half of 2022 to 12.8% in Q1 2025. Although this remains above the long-term average of 9.5%, the trend is positive.

However, rode data also reveals a regional divergence. Cape Town and Durban’s decentralised markets show vacancy rates just above 8%, possibly supported by a growing demand for call centre space. In contrast, Gauteng remains under pressure, with Q1 2025 vacancy rates of 14.1% in Johannesburg and 13.4% in Pretoria.

In terms of investment sentiment, 57% of brokers in the Q2 2025 FNB Property Broker Survey believe that office property supply still exceeds demand. However, this is down significantly from the record high of 98.4% in Q2 2021.

New Supply Has Slowed Dramatically:

A key factor in reducing oversupply has been the dramatic decline in new office space development. In 2024, only 82,942 square metres of office space were completed—an 86% drop from 2019 levels and a 90% decrease from the 2013 peak.

Affordability Improvements Support Recovery:

Real (inflation-adjusted) office rentals have declined by 16.5% from the 2020 peak to 2024, while real capital values per square metre have dropped by 25.9% since the 2016 high (MSCI data adjusted for GDP inflation). For both tenants and investors, office space has become more affordable—another factor helping to reduce oversupply.

Residential Conversions Are Playing a Critical Role —Especially in Johannesburg:

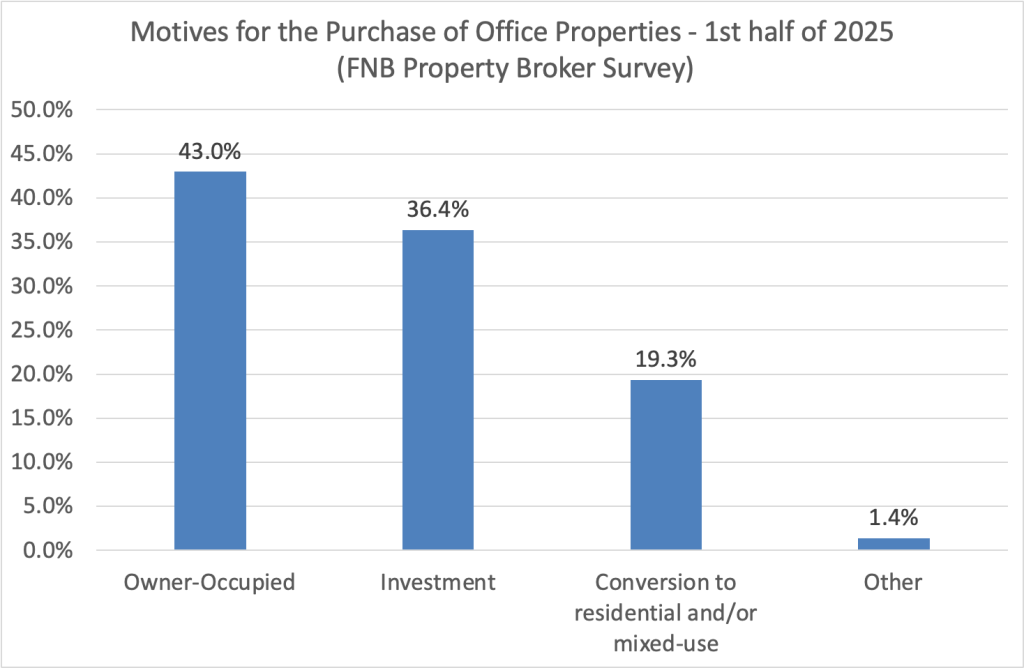

In Q1 2025, the FNB Property Broker Survey included a new question on the main reasons for buying office property. The options provided were:

- Company purchase for own office use

- Investment to lease as office space

- Conversion to residential or mixed use

- Other

Aggregated responses from Q1 and Q2 2025 provide revealing insights. Nationally, 43% of buyers were purchasing for their own use, while 36.4% were investors. A noteworthy 19.3% were acquiring office properties with the intention of converting them to residential or mixed use—an important mechanism for absorbing excess office space is unlikely to be needed in the future.

Regionally, Johannesburg shows the highest conversion intent, with 38.1% of office property purchases estimated to be for repurposing. Nelson Mandela Bay (17.1%) and Tshwane (14.9%) follow, while Cape Town (4.6%) and eThekwini (1.3%) show minimal conversion activity. These figures likely reflect healthier market fundamentals and lower vacancy rates in the coastal metros.

However, this also means that in cities like Cape Town, opportunities to address housing shortages by repurposing underused office space are limited—particularly in high-demand areas such as the City Bowl.

Conclusion:

The office property market is gradually “right-sizing” amid structural shifts in demand. While reduced new developments and improved affordability have played important roles, residential and mixed-use conversions—particularly in Johannesburg—are emerging as a key solution to the sector’s oversupply. The future of the office market lies in its ability to adapt to long-term changes in work patterns, economic conditions, and urban development needs.

John Loos , Senior Property Economist for Commercial Property Finance at FNB.He writes in his personal capacity.