Chantal Marx,

The introduction of the two-pot system, together with possible interest rate cuts, decent momentum in wages, and lower inflation could boost consumer confidence and drive an increase in spending in the months ahead. This is expected to be positive for domestic retailers, particularly discretionary names (clothing and furniture mainly). There could also be some benefit accruing to the banks, as savers may utilise their withdrawals to pay down debt, which could improve asset quality and free up capital to drive higher quality loan origination as well as higher transaction activity.

From 1 September, the two-pot retirement system comes into effect and South Africans will be able to withdraw money from the savings pot component of their pension savings. However, given the landscape this will also have implications for equities and investors in South Africa.

With this new system, one third of your future monthly retirement contributions will go into a savings pot that you can access once every tax year and two thirds will go into an investment pot, which will only be accessible upon retirement.

On 1 September, 10% of the market value of your retirement savings on 31 August 2024, subject to a maximum of R30 000, will be transferred to your savings pot through a once-off process called seeding. This will be accessible on the implementation date.

The idea behind this retirement reform is to discourage the early withdrawal of pensions (by resignation or voluntary retrenchment) by allowing pension fund savers access to a smaller pool of funds for emergency use. This is expected to also have a longer-term positive impact on net flows from South Africa’s pension savings pool.

It is estimated that about R40 billion will be withdrawn from pension assets when the two-pot system comes into effect. While this is a chunky figure, it is less than what is typically lost in early access every year (although this is anticipated to still be a factor but to a much smaller extent).

Of course, from a personal finance perspective, we would advocate for keeping “your fingers out of the pot”, but as an investor there are ways to benefit for others choosing not to do so.

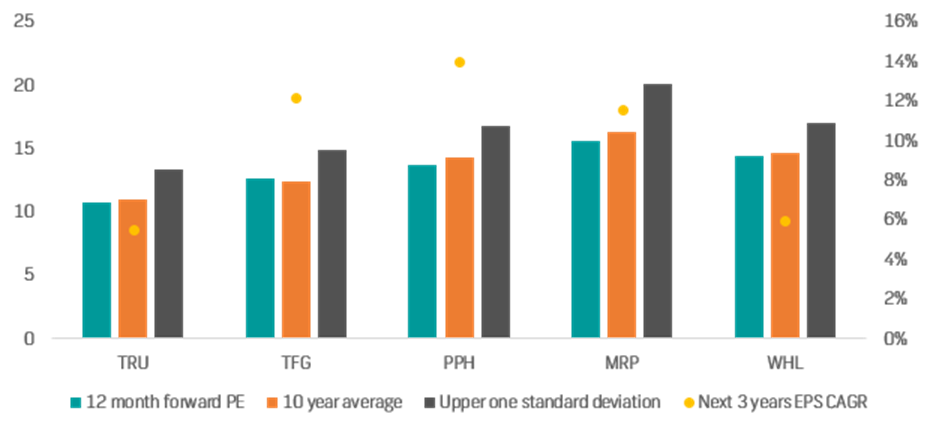

Retailers – PE and Growth

Source: Bloomberg

Among the larger discretionary retailers listed on the JSE, most are trading above their two- and five-year average PE ratings, however, delving into history and looking at growth rates changes the picture somewhat. All these retailers, bar TFG, are trading below their ten-year average forward PE’s and all these names are trading a long way off the upper end of their fair value range as expressed by the standard deviation. Growth still looks very solid over the next three years for TFG, PPH and MRP. With the above tailwinds in mind, including the two-pot windfall, there is still opportunity in these names, even more so in the event of any short-term weakness.

There is a flipside as well – the money must come from somewhere. It is expected that it will flow out of domestic bonds and cash – but given the size of these holdings in absolute terms, the flow impact is expected to be quite small. The introduction of the two-pot system may result in slight short-term pressure for asset managers, money managers, and insurers – but as noted in the first paragraph of this note, the long-term flow impact is still expected to be net positive.

Chantal Marx, Head of Investment Research, FNB Wealth and Investment. She writes in her personal capacity.

INFO SUPPLIED.