Consumer confidence continues to mend

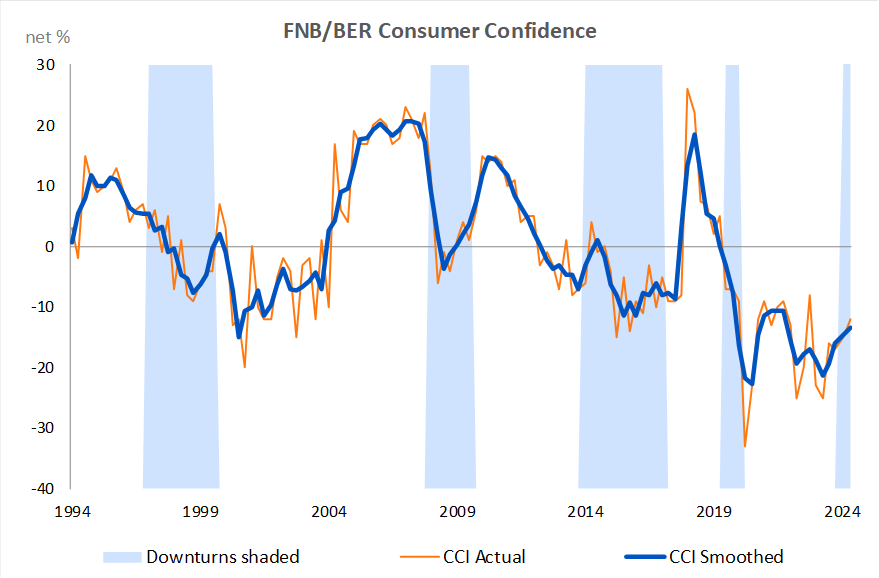

The FNB/BER Consumer Confidence Index (CCI) edged up further to -12 in the second quarter of 2024, after having improved from -17 to -15 index points in the first quarter of 2024.

The second quarter CCI survey was conducted between 3 and 14 June – after the results from the national election were declared, but before the configuration of the government of national unity (GNU) was finalised. At -12 (well below the long-term average reading of zero for the CCI since 1994), consumer sentiment remained decidedly negative in 2024Q2, with some consumers probably still quite uncertain about which parties would join the GNU. Nevertheless, the latest consumer confidence reading is the highest in 18 months (since 2022Q4, when the CCI reached -8) and points to a gradual improvement in consumer spending compared to the very weak performance recorded over the last year.

Source: BER, SARB

Details

The increase in the CCI during the second quarter of 2024 can be ascribed to a further improvement in the economic outlook sub-index of the CCI and a slight increase in the sub-index measuring the appropriateness of the present time to buy durable goods (e.g., vehicles, furniture, household appliances and electronic goods). Having bounced back from -28 to -22 in the first quarter, the economic outlook sub-index extended its gains to reach -16 in the second quarter – the highest economic outlook reading since the fourth quarter of 2021. Following a slump from -25 to -30 in the first quarter, the time-to-buy durable goods sub-index of the CCI posted a partial recovery to -28 in the second quarter. The household finances sub-index of the CCI remained steady at 8 during the second quarter, after three consecutive upticks from -2 in the second quarter of last year.

| 22Q1 | 22Q2 | 22Q3 | 22Q4 | 23Q1 | 23Q2 | 23Q3 | 23Q4 | 24Q1 | 24Q2 | |

| Overall FNB/BER CCI | -13 | -25 | -20 | -8 | -23 | -25 | -16 | -17 | -15 | -12 |

| Economic outlook | -18 | -39 | -31 | -19 | -34 | -37 | -22 | -28 | -22 | -16 |

| Household financial outlook | 8 | -5 | -2 | 13 | -1 | -2 | -1 | 3 | 8 | 8 |

| Suitability of the present time to buy durable goods | -28 | -32 | -28 | -17 | -34 | -35 | -26 | -25 | -30 | -28 |

Source: BER

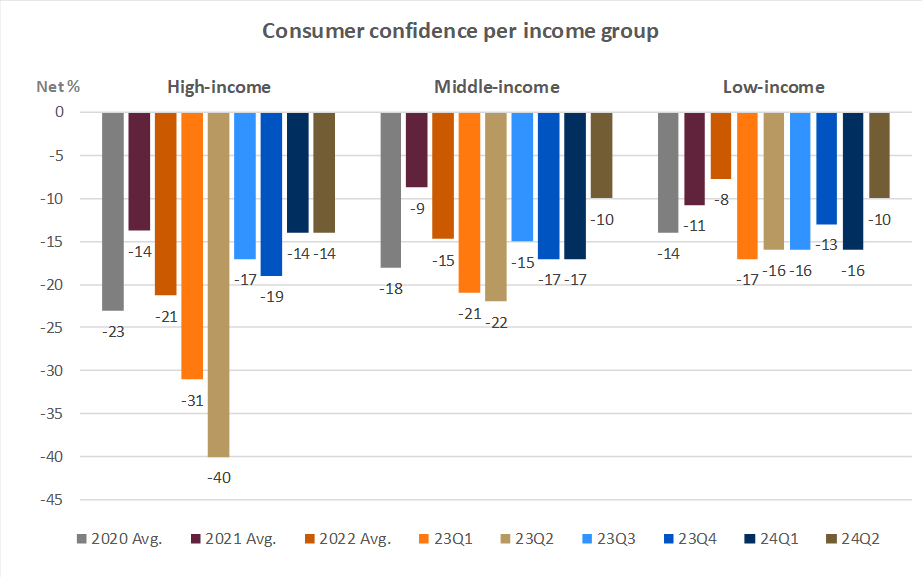

A breakdown of the CCI per household income group shows that the slight improvement in overall confidence was driven by an uptick in the confidence levels of middle- and low-income households. The confidence levels of middle-income households (earning between R5 000 and R20 000 per month) jumped from -17 index points to 10, while the confidence of low-income households (earning less than R5 000 per month) improved from -16 to -10. However, the confidence levels of high-income households (earning more than R20 000 per month) remained unchanged at -14 during the second quarter.

Source: BER

FNB Chief Economist Mamello Matikinca-Ngwenya said “Positive developments such as the cessation of load-shedding during the second quarter, substantial cuts in fuel prices in June, a R20 increase in the SRD grant from April and a significant deceleration in food inflation likely buoyed confidence levels, particularly among low- and middle-income consumers. However, high interest rates and uncertainty over which parties would form part of South Africa’s government of national unity probably kept the lid on high-income confidence. Provided that the GNU remains intact and the JSE and rand exchange rate hold onto their recent gains, there is scope for an improvement in high-income confidence during the third quarter.”

Bottom line

Real growth in consumer spending has sorely disappointed over the last year, with a 0.4% year-on-year (y-o-y) contraction in the first quarter of 2024 (-0.3% quarter-on-quarter). The gradual improvement in consumer sentiment, coupled with lower inflation, should boost real household consumption in the coming months. However, with the prime interest rate still at a 15-year high of 11.75%, consumers continue to shy away from big-ticket durable goods – as indicated by the 11.7% y-o-y contraction in new passenger car sales in May 2024. Should the positive sentiment towards SA hold (following the formation of the GNU), the stronger rand exchange rate will allow for lower import prices and provide scope for the SARB to cut the prime interest rate in September – this should ignite a stronger recovery in consumer spending towards the final quarter of 2024.

Background

Consumer confidence surveys provide regular assessments of consumer attitudes and expectations and are used to evaluate economic trends and prospects. The surveys are designed to explore why changes in consumer expectations occur and how these changes influence consumer spending and saving decisions.

The FNB/BER CCI combines the results of three questions posed to adults in South Africa, namely the expected performance of the economy, the expected financial position of households and the rating of the appropriateness of the present time to buy durable goods, such as furniture, appliances and electronic equipment.

Until the second quarter of 2019, the FNB/BER CCI was based on face-to-face interviews of between 2 000 and 2 500 urban adults. The BER switched to telephone call surveys in the third quarter of 2019. The 500 respondents are representative of the racial and household income composition of the urban adult population of South Africa. Internationally, the majority of CCIs is based on telephone call surveys.

Consumer confidence is expressed as a net balance. The net balance is derived as the percentage of respondents expecting an improvement / good time to buy durable goods less the percentage expecting a deterioration / bad time to buy durable goods.

A low level of confidence indicates that consumers are concerned about the future. They may be worried about job security, pay raises and bonuses. With such a frame of mind, consumers tend to cut spending to basic necessities (e.g. food and services) to free up income for debt repayment. If confidence is high, consumers tend to incur debt (or reduce savings) and increase spending on discretionary items, such as furniture, household equipment, motor vehicles, clothing and footwear. Some of these items are often financed on credit. Spending on these items declines when confidence is low, as households can generally delay their purchase without experiencing an immediate deterioration in living conditions.

A rise in consumer confidence reflects an increased willingness of consumers to spend. However, this willingness only translates into actual sales if consumers’ ability to spend improves. Their ability to spend depends on their inflation adjusted after-tax income and the availability of credit. A rise in consumer confidence could therefore result in an upturn in household consumption spending in general and retail and motor vehicle sales in particular. The opposite applies when the level of consumer confidence declines.

Mamello Matikinca-Ngwenya is FNB Chief Economist. She writes in her personal capacity

INFO SUPPLIED.