Rooftop solar installations more than doubled in South Africa at the height of loadshedding, however the situation improved significantly in 2024, with the country now having experienced over 200 days without scheduled blackouts. This reduction in loadshedding led to a tapering interest in home rooftop installations after the boom of 2023. However, a new trend has emerged as electricity tariff increases drive renewed interest in solar installations.

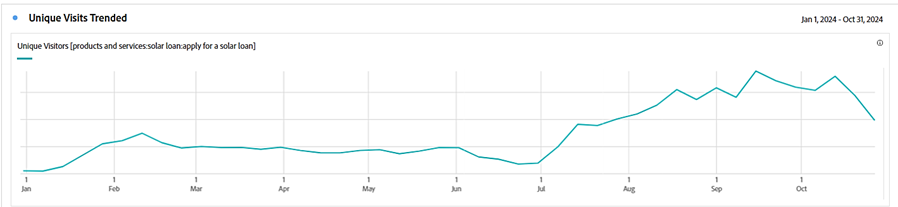

Data from Standard Bank’s LookSee home efficiency platform shows a notable rise in visits to its Solar Loan finance page. While these visits do not represent actual applications South African consumers submitted, it indicates that South Africans are now considering embedded generation to combat rising electricity costs.

Marc du Plessis, executive head of LookSee noted, “Interest in our Solar Loan started climbing in July as many municipalities rolled out their annual electricity tariff hikes. We continued to see a steady increase with additional spikes in interest following reports that Eskom was asking for another significant increase in electricity tariffs for 2025.”

This renewed interest tripled the average number of visits from the first half of the year by September.

Eskom’s latest Generation Adequacy Report also show that rooftop solar installations continue to accelerate. It estimated that installed Rooftop PV set at 6,141.4 MW by the end of October from 5,203.7 MW at the end of 2023.

Du Plessis attributes this increase in the absence of loadshedding, to the increasing pressure rising electricity tariffs are placing on households.

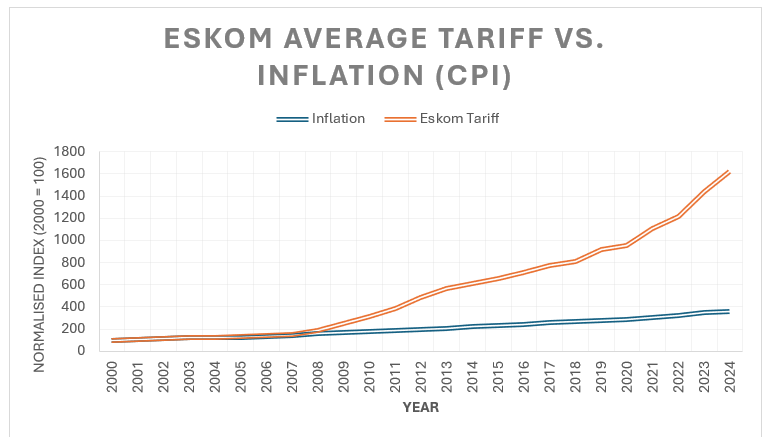

“The past 15 years have seen tariff increases far outpacing inflation and Eskom is now asking for a 36% increase for direct customers and a 43.5% increase for municipalities for 2025. These escalating prices are placing enormous strain on household budgets, and many are looking for ways to reduce their reliance on the grid. Solar power is the most effective way to do this,” says Du Plessis.

Du Plessis also points out that lower component prices and enhanced finance options have improved affordability – and thereby accessibility – of residential solar installations.

“With demand at more manageable levels, we have seen the cost of components dropping by up to as much as 30% since the beginning of the year. And on the financing side, banks are doing more to help households acquire solar systems.”

Government’s Energy Bounce Back Loan Guarantee Scheme, on which Standard Bank’s Solar Loan is based, has provided unsecured solar financing for households with interest rates capped at prime plus 2.5%. However, this limited-time offer will expire in February 2025.

To replace, Standard Bank has developed an Energy Loan that will provide attractive finance terms to help households finance approved solar, backup power and energy-efficient solutions. This aligns with growing customer demand, as data from Standard Bank Home Services shows that those who have registered higher bond amounts are using those funds for future rooftop solar installations. Currently, 12% of future use benefits are currently being allocated to solar installations.

“We believe the solar market has stabilised following the surge driven by high levels of loadshedding. Moving forward, we expect residential interest to continue growing, especially as further electricity tariff hikes are approved.

“The challenge for the industry now is to develop offerings that are both appealing and affordable to a broader segment of the market, enabling more families to benefit from the cost savings of solar power. However, this must be done without compromising on the quality of components, as this directly impacts the efficiency and longevity of these systems,” adds Du Plessis.

INFO SUPPLIED.