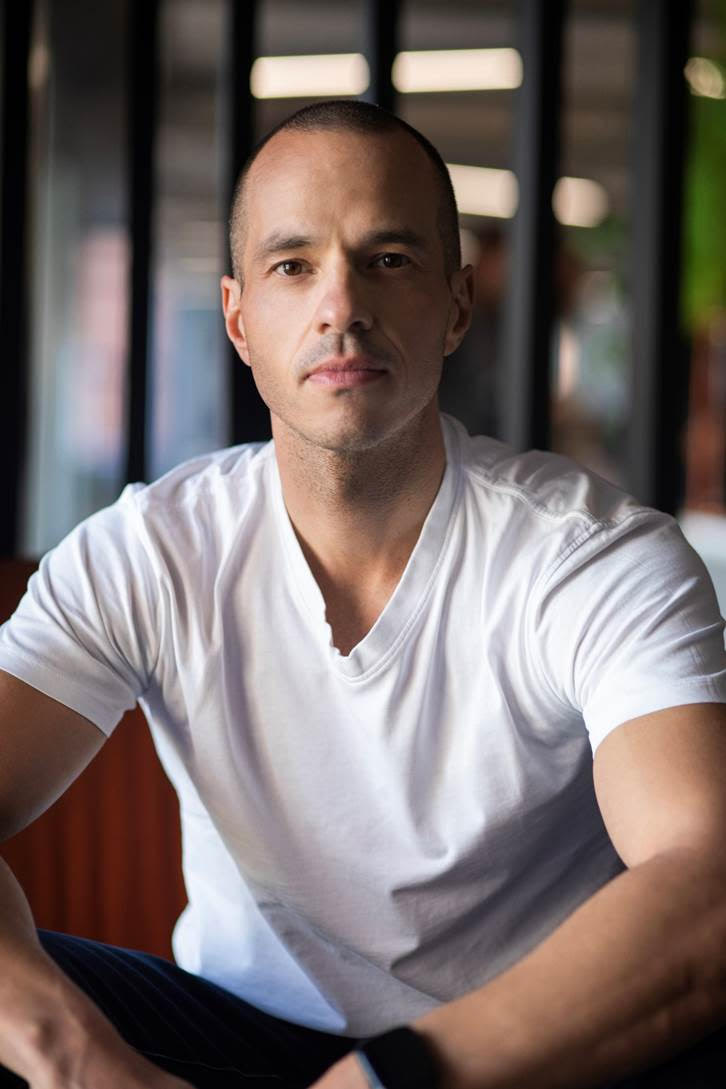

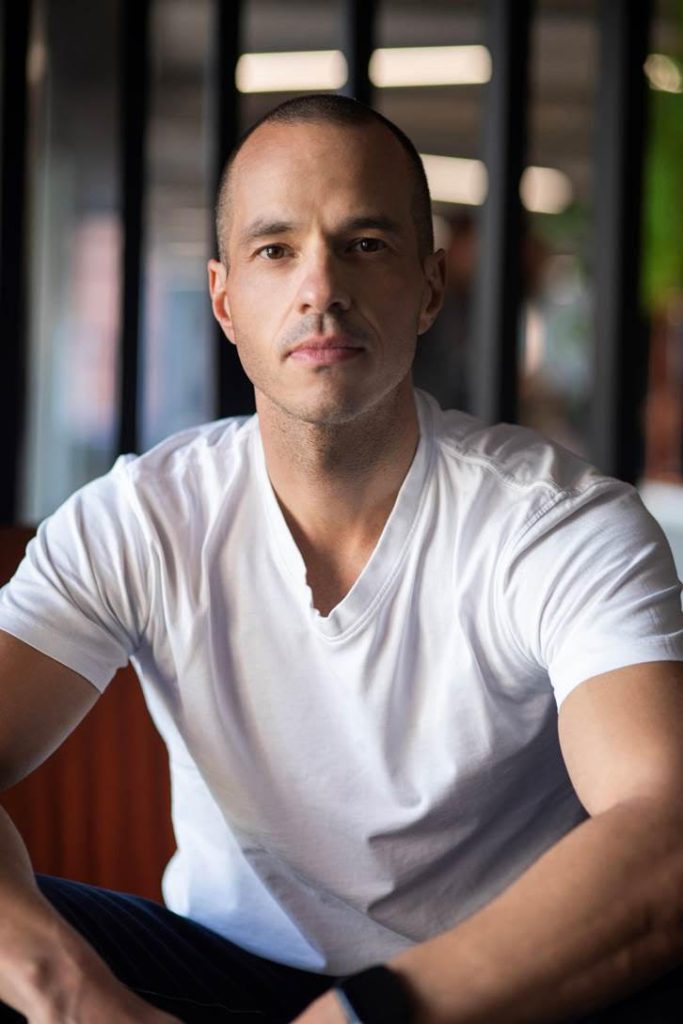

Bradley Elliot

Taxation issues are a familiar case for South Africans. Every taxpayer will always begrudge rises, as the phrase “only certainties in life being death and taxes” will attest, but recently proposed increases feel particularly unwanted.

Beyond personal gripes, this new fiscal restructuring could unintentionally amplify risks throughout the private and public sectors.

Tax crime is a serious offence where any changes to the system can create new opportunities for evaders and other offenders, which, of course, also spells trouble for the combating anti-money laundering (AML) and counter-terrorist financing (CTF) capabilities in all areas of society.

Now is a pivotal time in South Africa’s tax discourse; with the country juggling FATF greylist delisting, precarious financial health, and a new ‘triple tax’ for the government’s National Health Insurance (NHI) plan. Ensuring strengthened compliance against high-risk activity is non-negotiable before problems proliferate.

Where tax problems persist

South Africa’s high tax rates are an unfortunate reality. In fact, they mark the highest of the African countries according to PwC. As this continues to rise through the triple tax, an effort to pool funds for the NHI from taxpayers through medical aid contributions via income tax, payroll tax, and the loss of medical aid credits, we may see some adverse economic repercussions.

South Africa looks to be following the Laffer Curve principle, where tax revenues may fall following an increase past a threshold, as economist Davie Roodts outlines. This may be due to wealthy citizens exiting the country or through high levels of evasion, which is already a direct consequence of raised taxes. The country faces prominent cases of evasion in sin taxes.

There’s a perpetual cycle in motion with the tax issue as a hidden gremlin. When taxes or levies are increased to solve a problem, it sparks creative ways for people to minimise how it will impact them. High incomes may be underdeclared, or worse, shifted to offshore accounts and set up in the names of shell companies.

Fronts may inflate invoices or falsify claims for medical aid schemes in this healthcare context, and individuals could turn to the informal financial system where criminals conduct their business.

Is state-wide AML strong enough?

In the AML world, where beneficial ownership information is mostly under lock and key (or at the behest of the stakeholders themselves), financial institutions already under strict compliance to find links to tax avoidance or payroll manipulation can be flooded with illicit fund flows. That’s unless onboarding verification and transaction monitoring are airtight, not easy to ensure across the ecosystem.

This landscape extends to government AML as well, and its ability to identify suspicious transactions, as well as politically exposed persons (PEPs) or sanctioned individuals. South Africa’s risk profile has been historically worrying considering high-profile state capture cases and PPE fraud under localised government (already a system that’s a complex web fraught with non-compliance, “financial misconduct” and “procurement deviations”), where large state-fund plans like the NHI can be hugely susceptible to money laundering activity.

Complex distribution chains also present multiple gaps for procurement fraud, involving potentially fictitious vendors or supplier costs being inflated. Contracts can invite kickback, and also bribery schemes, while state tenders through intermediary parties are fertile ground for common laundering techniques.

Potentially, pooling taxpayers into centralised state accounts presents opportunities for fund diversion unless the government’s know-your-customer (KYC) verification, transaction auditing, and reporting are robust. South Africa’s response to the FATF greylisting identified commendable efforts to harmonise private and public AML/CTF communication; however, these new healthcare tax hikes ramp up the pressure for even more diligent approaches to compliance.

Addressing the digital divide

There’s also the underlying spectre in all AML compliance: that any chink in the armour leaves the whole private and public world open to facilitating illicit funds or unintentionally doing business with criminal networks.

Medical aid taxation may play a similarly unintentional role, as those out of pocket to pay for private healthcare may turn to other sources. This feels especially pertinent given the NHI scheme’s “vague timelines” could result in citizens being thrice taxed for still paying for private services.

Alternative financing poses a significant threat to cooperative compliance safeguards, operating under the guise of healthcare provision. Informal lending, unregulated health cover providers or crypto-based ‘insurance’ platforms are out of scope for AML/KYC regulations primed on large financial institutions and fintechs, essentially the loopholes that launderers always manage to sneak through.

So, what does this mean? Rather than deviating from AML progress, this recent news only highlights progress South Africa has made in bridging the bonds between regulators, government agencies, and accountable institutions. Cooperation is one thing, yet it’s another to promote and implement tech-driven compliance partnerships and tools that are proactive to any behavioural anomalies, and digital identity and fund manipulation, that can result from legislative shifts.

Time will tell as to the effects of the triple tax on the taxpayer, and to South Africa’s fast-tracked rectification of anti-fincrime controls across the public and private sectors. Positively, it forces the needs for constant adaptation where regulatory technology can unite AML capabilities, but only if the real risks are noted, and addressed, by those tasked with keeping launderers from infiltrating our financial landscape.

About RelyComply

RelyComply empowers banks, insurers, financial services providers, and innovative fintechs with a single, fully integrated KYC and AML platform. Designed for seamless implementation and rapid deployment, our intelligent technology enhances efficiency while detecting financial crime, enabling you to reduce risk and costs, ensure compliance, and drive strategic growth.

Bradley Elliott, CEO of Anti-Money Laundering (AML) platform RelyComply. He writes in his personal capacity.