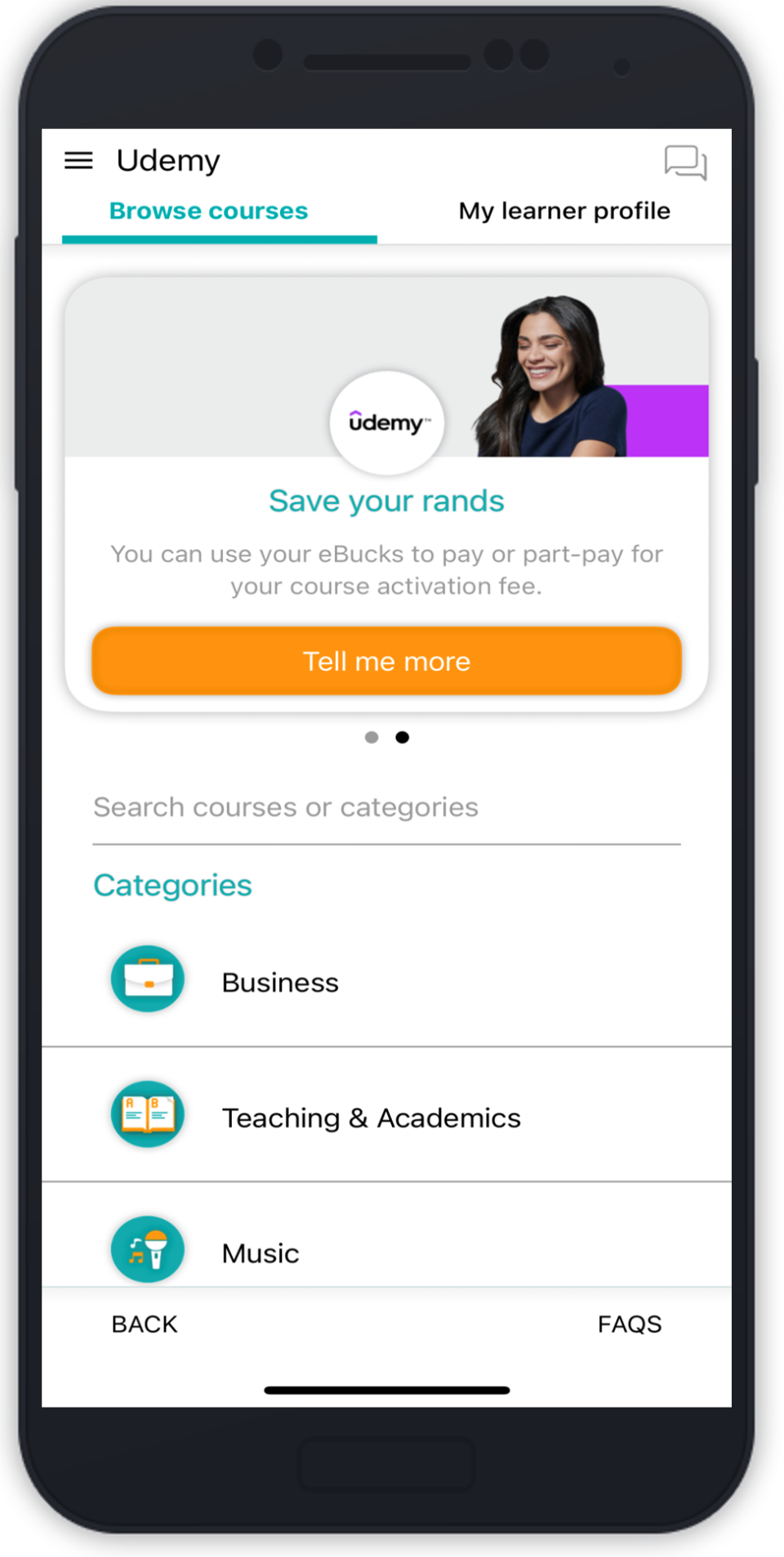

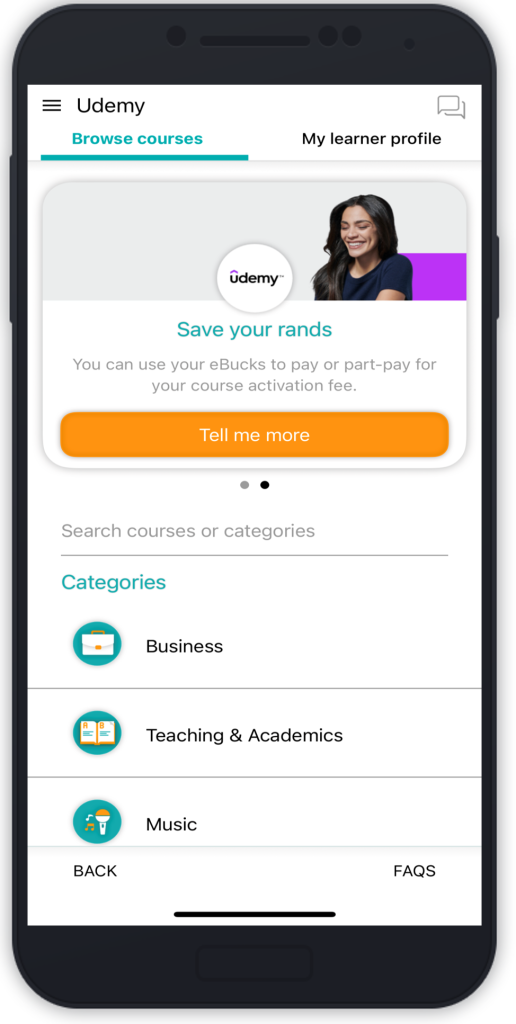

In just three months, over 12,000 FNB and RMB Private Bank customers have learnt practical skills like project management, Microsoft Excel, public speaking and computer programming through the recently announced partnership between Udemy, a leading destination for learning and teaching online, and FNB’s eBucks. Using an innovative learning solution, customers can select from 400 curated high-quality courses from Udemy and enroll in up to six courses per year for a discounted R50 fee per course, directly from within the award-winning FNB App. In addition, they can also stretch their rands further by redeeming their eBucks to pay for their courses.

This is the first partnership in which Udemy has built a mobile app experience within a partner’s mobile application. Udemy is a learning company serving more than 52 million students and 68,000 instructors, and FNB is one of the largest financial services providers in Africa serving over 10 million customers.

Business Support Head at eBucks, Graeme Parsons, is particularly proud of the Udemy solution, stating that financial inclusion requires upliftment and access to skills that can truly change people’s lives. “We’ve had an incredible take-up and our customers now also trust us to help them achieve their goals with new skills through a digital learning solution. Providing affordable access to online learning is part of a range of lifestyle solutions that are helping customers beyond traditional financial services.”

Access to learning and contextual lifestyle solutions is part of FNB’s goal of becoming a trusted partner through an innovative digital platform. Industry leading capabilities like data and analytics make it possible to provide integrated solutions for customers to manage their money and lifestyles more effectively. The range of Udemy courses that are available to FNB customers include entrepreneurial topics like ecommerce, real estate, investing and farming.

“We’re proud to offer content created by real-world experts that empowers individuals and organisations to achieve their goals,” said Llibert Argerich, Senior Vice President of Marketing at Udemy. “We believe that up-skilling and re-skilling can enhance productivity and help FNB customers adapt to a rapidly changing professional landscape.”

The demand for innovative financial services and online learning solutions will continue to grow as the world digitizes and firms take advantage of new technologies to improve the customer experience. Convenience is driving adoption and the partnership between FNB and Udemy is an example of customer-centric innovation and how these platforms can work together. But it’s context that really matters; customers are already using FNB’s digital platform to learn highly individualised skills like French, aromatherapy, guitar and even reflexology. Next time you manage your money on the FNB App, why not enroll for a course and gain a new skill; it might even help you grow your balance.

FNB’s exponential helpfulness also includes a comprehensive range of other lifestyle solutions such as coffee at Starbucks, personal security with GuardMe, ad-free games and airport lounge access.

INFO SUPPLIED.